INSIGHTS

Infra investments need to rise over the next decade: CRISIL

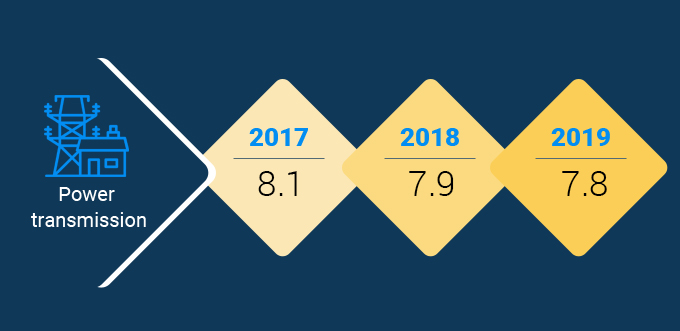

Power transmission remains a balanced investment destination

Infrastructure investments by Indian states need to rise to more than Rs 110 lakh crore over the next decade (fiscal 2021-2030), which translates to 3.5 times of what has been invested over the previous 10 years, as per CRISIL Infrastructure Yearbook 2019.

The report traces the steady growth in infrastructure over the past few years and emphasizes to tap asset monetization potential in power transmission sector and state-owned generation assets to unlock resources.

CRISIL InfraInvex 2019: India's First Investability Index

Areas that require impetus are implied in the scores for CRISIL InfraInvex 2019, an index that measures and assesses the investment attractiveness and development maturity of infrastructure sectors.

In Power Transmission, the index was at 7.8 in 2019 with the sector being conducive to PPPs and asset monetization. Pan-India transmission line capacity logged 7.1% CAGR between fiscal 2015 and 2019, led by improving inter-regional transmission capacity. The Government of India (GoI) approved transmission schemes of Rs 43,200 crore for RE zones with a potential capacity of 66.5 GW, to be achieved by 2022.

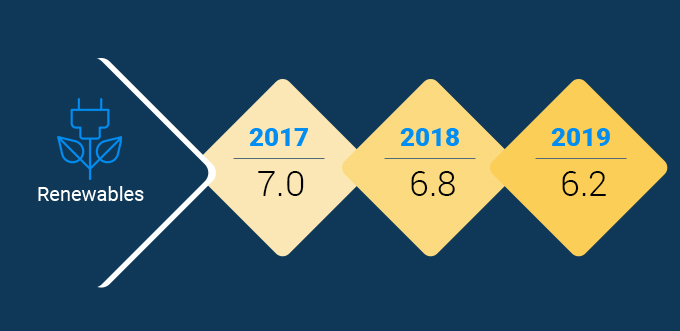

In Renewables, the index was at 6.2 in 2019 mainly because of the reopening of past PPAs, tariff caps, bid aggression and rising payment delay risk. Nevertheless, strong push at the central level by exempting inter-state transmission charges, centralised procurement and favourable changes in bid guidelines supported the sector.

Conventional power generation continued to retain the same level of 5.1 in 2019. Centralized procurement, coal linkage and mandatory letter of credit contributed to the index retaining its level.

CRISIL InfraInvex 2019 snapshot

CRISIL highlighted that for the country-wide infrastructure, a spend of Rs 235 lakh crore over the next decade is required to lift and sustain average GDP growth at 7.5 percent. Infrastructure spending of above 6 percent of GDP will help achieve this.

The share of the private sector (in ckms) rose to 7.4% in fiscal 2019 from 5.6% in fiscal 2015 in the transmission segment. In fiscal 2019, Rural Electrification Corporation (REC) and Power Finance Corporation awarded 9 projects based on tariff-based competitive bidding (TBCB). CRISIL recommended that PGCIL should mandatorily compete under the TBCB and auction route.

The study highlighted that as a nation we need to tap asset monetization potential in power transmission and ring fence these funds to create new transmission and grid capability to handle a higher share of renewable power.